|

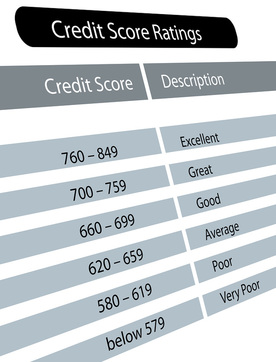

A credit score is a number based on the information contained in your credit report. There are multiple credit reporting agencies and many have their own scoring system based on secret formulas. The mostly widely used system is called the "FICO" score as developed by the Fair Issac Corporation, a for profit company. Lending institutions use this score to measure the risk involved with giving you a loan. FICO scores range from 300 to 850, with the higher number being best. It is important to regular monitor and fix credit report errors as soon as possible by disputing an innaccuate information contained on your credit profile.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |